So what people did they took the term policy by providing false information online.

Moreover medical tests are not compulsory for Sum Assured 50 Lac. I have gone through the same phase few months ago and finally opted for Aegon Religare.Īs far as Aegon Religare is concerned it was first Insurance company in India to offer online term plan. I also understand that if I disclose all the information while proposing the policy, nothing on earth would be able to stop my claim, but low ratio is somehow discouraging and I would not like to have even an iota of doubt in my mind before buying something as crucial and important and as a life insurance. What do you think I should do? And if you can recommend any other company term plan for 35-40 years (possibly with riders). He has asked for two more days o discuss it with his team and respond back. It would seriously help me putting aside my doubts. Wouldn’t it help if they can somehow publish the settlement ratio of this individual plan. I told him that their term plan is one of the best in market but is losing a lot of prospective clients due to low settlement ratio. Then I explained to him why I am asking this document. I talked to him again today and asked if he can show me these numbers in a company document to which he expressed his inability since these are company internal documents. I am withholding the name of the person due to obvious reasons. I am attaching his reply below.Īs discussed please find the below claim settlement ratio for last 3 years: So I asked Aegon relationship manager to provide me death settlement ratio figures for last three years of this particular policy i.e iTerm on a company document.

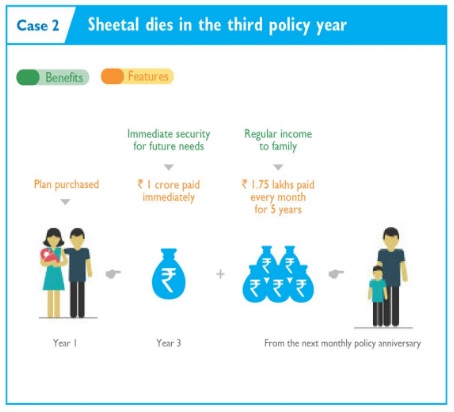

I understand the in the IRDA pdf, the numbers which are shown are for all the policies and not just term plans. However, as mentioned everywhere and at your website too, the settlement ratio of Aegon is very low (bottom three). Out of these Aegon Religare’s iTerm plan stands out of the crowd ad wins hands down owing to the option of riders at minimum cost (accidental and critical illness) and option to avail it till 75 years of age. My dilemma occurs out of the fact that only Aegon, Aviva and LIC are offering a term plan for more than 30 years. So I understand, I need a policy for at least next 33 years. However, as per your advice as well as others, term plan insurance is must at least till the age of retirement that is 60 years. I am thinking of buying a 1 crore term plan insurance for me. In life stage option one can choose and increase the sum assured upto a specific limit of the original sum assured.I am a 27 year old software engineer working in Mumbai. During the policy term if due to an unfortunate event he dies, then his nominee receives Rs 60 lakhs immediately and monthly income of Rs 48000 for next 100 months. 8676 for 50 years of policy term under this Aegon life i term insurance plan. If suppose an individual is diagnosed with any terminal illness then he gets 25% of the sum assured immediately and on his death the nominee gets death benefit.Ĭonsider a 30 year old, pays an annual premium of Rs.

Under this Aegon Life i-term plan, an individual can choose a policy term from between 5 to 62 years or a fixed policy term till he turns 100 years old and premium payment mode.

0 kommentar(er)

0 kommentar(er)